The AI Tax: Why Your Next Computer and Car Are Becoming Collateral Damage in the Silicon Supercycle

The semiconductor industry has entered a new, more volatile era. While the global supply chain disruptions of the early 2020s were defined by clogged ports and empty shelves, the crisis of 2026 is far more fundamental. It is structural. We are no longer facing a logistics problem; we are facing a Memory Supercycle fueled by the insatiable appetite of Artificial Intelligence.

The semiconductor industry has entered a new, more volatile era. While the global supply chain disruptions of the early 2020s were defined by clogged ports and empty shelves, the crisis of 2026 is far more fundamental. It is structural. We are no longer facing a logistics problem; we are facing a Memory Supercycle fueled by the insatiable appetite of Artificial Intelligence.

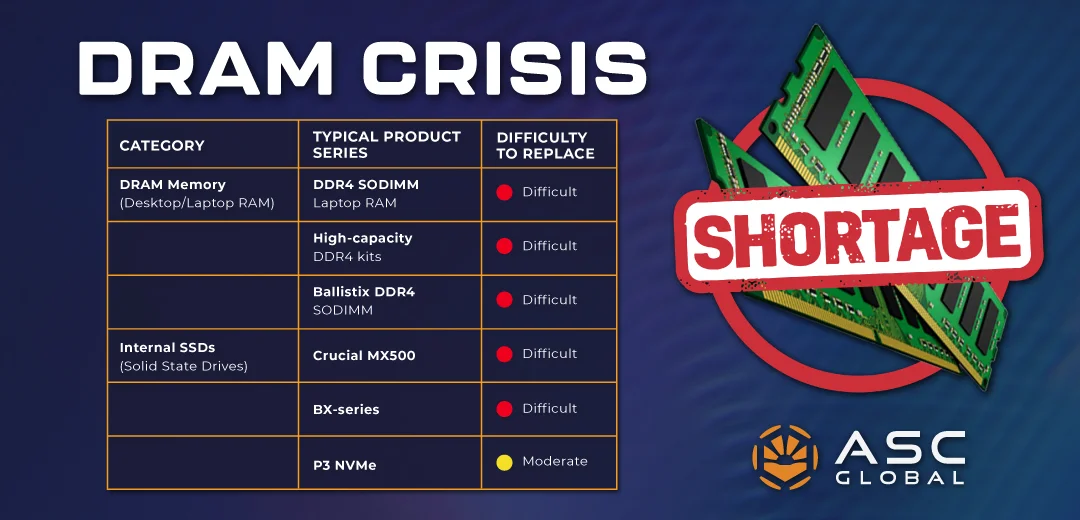

At ASC Global, our Q1 2026 market analysis reveals a stark reality: the world’s manufacturing capacity is being reallocated at an unprecedented rate. To feed the demand for AI infrastructure, major fabs have pivoted away from the conventional memory such as DDR4 and DDR5 that powers laptops and vehicles, focusing instead on High Bandwidth Memory and enterprise grade SSDs.

The Death of the DIY Market?

The most visible casualty of this shift is the retail consumer. In a move that signaled the end of an era, Micron recently announced the complete dissolution of the Crucial brand, a staple for PC builders for decades. By reallocating all retail wafer starts to HBM4 and enterprise production, Micron has effectively exited the DIY market.

This is not an isolated incident. With SK Hynix reporting that its 2026 capacity is already sold out and Samsung raising contract prices by as much as 60 percent to meet AI driven margin targets, the retail and non enterprise sectors are becoming crowded out. We project that average selling prices for PCs will rise 8 percent this year, potentially shrinking the global PC market by 9 percent as manufacturers struggle to absorb these costs.

The Legacy Squeeze in Automotive

The impact extends far beyond the home office. The automotive and industrial sectors are facing a double threat. Manufacturers are retiring older memory nodes such as DDR4 and LPDDR4 faster than the automotive sector can redesign its long cycle systems. These high reliability, low volume parts are now competing for the same silicon wafers as high margin AI chips. The result is price increases of up to 70 percent for automotive qualified DRAM.

The Return of Panic Buying

We are seeing a return to the panic buying and double ordering that defined 2021. Hyperscalers such as Meta, Google, and AWS have adopted open ended procurement strategies, essentially buying every available chip regardless of price. This leaves smaller OEMs and Tier 2 data centers in a precarious position, forced to prioritise continuity of supply over price optimisation.

The Road Ahead: 2026 to 2027

Industry consensus indicates that supply will remain structurally tight through at least 2027. While new fabrication plants are under construction in Texas and South Korea, they will not offer meaningful relief during the current fiscal year. For the next 18 months, the industry must brace for a bullwhip effect. The priority for any business reliant on silicon is shifting from asking how much it costs to whether it can be secured at all.

As AI continues to reshape the global economy, the memory shortage is becoming the first major tax on that progress, one that every consumer and corporation will eventually pay.