Samsung Electro-Mechanics is repositioning its MLCC business to meet the demands of two markets with very different but equally aggressive growth trajectories: AI servers and automotive electronics.

Samsung Electro-Mechanics is repositioning its MLCC business to meet the demands of two markets with very different but equally aggressive growth trajectories: AI servers and automotive electronics.

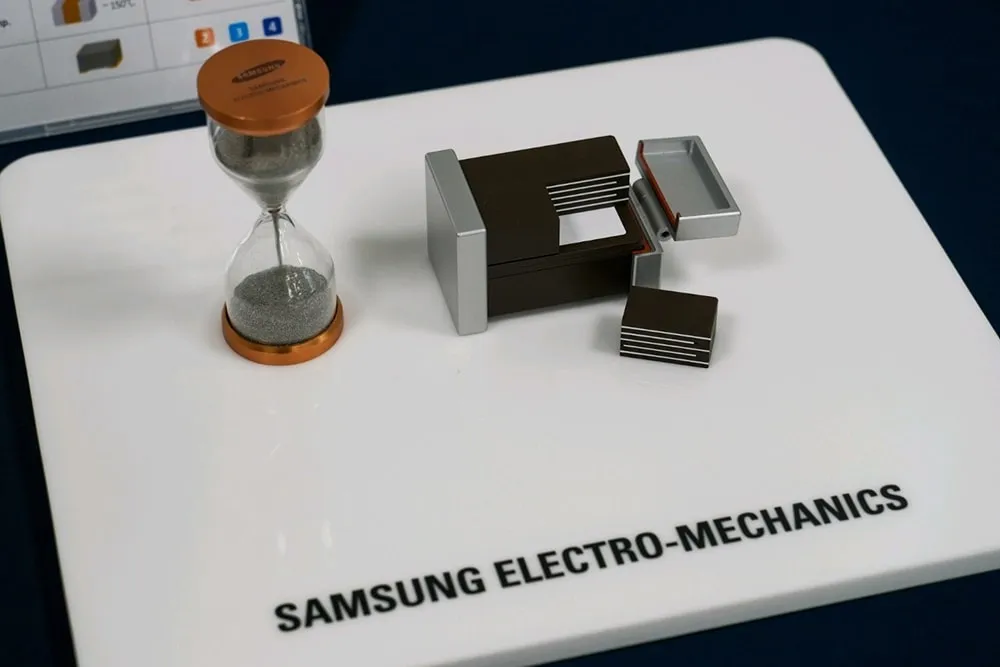

MLCCs, multi-layer ceramic capacitors, aren’t new. They’ve been used in smartphones, laptops, and other consumer tech for years. But the scale and performance requirements are changing. Today’s systems, especially AI servers and electric vehicles, need far more capacitors, packed into tighter spaces, running hotter, and expected to last longer under stress.

Why AI and EVs are Driving MLCC Demand

AI servers are packed with GPUs and ASICs that draw significant power. This puts new pressure on the passive components that surround them. MLCCs used in these platforms need to be compact, high-capacity, and stable at temperatures of 105°C or more.

Electric vehicles are even more demanding. A single EV might need up to 30,000 MLCCs. These are often exposed to temperatures above 125°C, voltages up to 2000V, and must remain stable in environments with constant vibration and high humidity. Some sit in safety-critical areas of the vehicle, which adds another layer of scrutiny.

Samsung’s recent MLCC development efforts have focused on pushing performance in exactly these areas: thermal stability, voltage endurance, miniaturisation, and long-term reliability.

Complex, Not Just Small

The smallest MLCCs are about the size of a grain of salt. But inside, they can contain 500 to 1,000 individual layers of ceramic and metal. These are stacked, fired, and then tested, all without introducing microcracks or contamination that could cause long-term failures.

Getting this process right is not trivial. The ceramic materials used must be carefully blended and processed. Even slight changes in the composition affect capacitance, dielectric strength, and thermal response. That’s why Samsung doesn’t just manufacture MLCCs, it also develops and produces the raw materials in-house.

The company completed a ceramic material plant at its Busan site in 2020, specifically to support automotive-grade MLCC production. R&D work is handled out of Suwon and Busan, while production is carried out in Tianjin and the Philippines.

AI Server MLCCs: More Heat, Less Space

AI servers don’t just use more capacitors, they also create far more heat. That’s especially true when stacking multiple GPU boards in a compact enclosure. As power increases, so does the need for capacitors that can perform reliably under stress.

Samsung is targeting this space with MLCCs designed for high density and high temperatures. Devices are rated for operation above 105°C, with rated voltages around 100V, and strong resistance to mechanical stress and humidity. These parts also need high bending strength due to the way boards are assembled.

According to MarketsandMarkets, the global AI server market is expected to grow from $142.9 billion this year to $837.8 billion by 2030. Samsung estimates that it already holds about 40% of the MLCC market for AI servers.

Automotive MLCCs: Longer Cycles, Higher Stakes

In automotive, the requirements go beyond endurance. Safety is involved. That means longer development timelines, stricter validation, and far more testing.

MLCCs must pass AEC-Q200 and often go through bespoke qualification with individual customers. The design rules are tough: operation from –55°C to 150°C, tolerance for humidity above 85%, and resistance to constant vibration.

Samsung’s roadmap in this area has moved fast. It entered the automotive market in 2016. In 2021, it released MLCCs for ADAS systems. A year later, it added 13 models for automotive powertrains. In 2024, it launched 16V MLCCs for ADAS with record capacitance and 2000V MLCCs aimed at EVs. For 2025, the plan is to introduce MLCCs tuned specifically for LiDAR applications.

Market conditions support this push. McKinsey expects Level 2+ ADAS adoption to reach 65% by 2030, up from 44% in 2025, with the total market value climbing from $38.5 billion to $65 billion.

What Comes Next?

Samsung isn’t stopping at automotive and AI. The company is also watching the robotics space. Humanoid platforms in particular may drive future demand for compact, high-stress MLCCs.

With in-house ceramic expertise, a strong production base, and a focus on technically demanding applications, Samsung Electro-Mechanics is positioning itself as a long-term supplier of MLCCs where failure isn’t an option.

Read the full original, expanded article here.